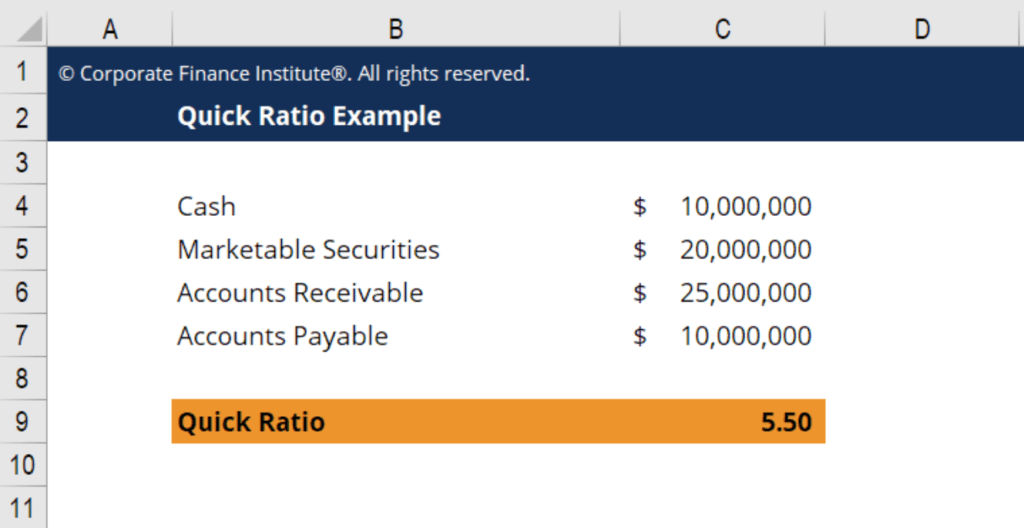

Obviously, as the ratio increases so does the liquidity of the company. This is a good sign for investors, but an even better sign to creditors because creditors want to know they will be paid back on time. In most companies, inventory takes time to liquidate, although a few rare companies can turn their inventory fast enough to consider it a quick asset. Prepaid expenses, though an asset, cannot be used to pay for current liabilities, so they’re omitted from the quick ratio. The quick ratio measures the dollar amount of liquid assets available against the dollar amount of current liabilities of a company.

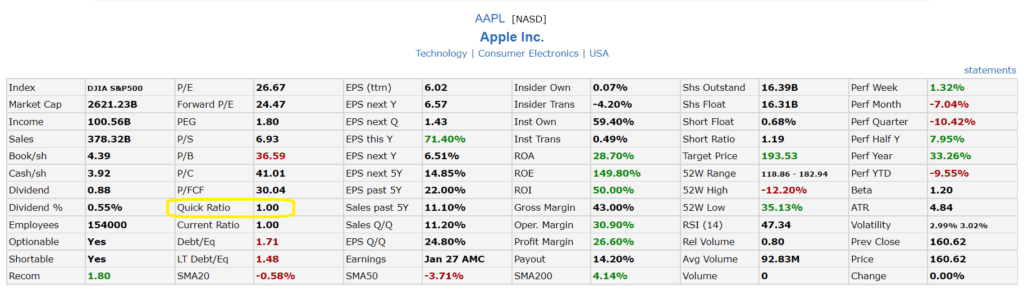

What is a company’s quick ratio?

A higher ratio indicates that the company has more liquidity and financial flexibility. For example, if a company has $1,000 in current liabilities on its balance sheet. But also has $1,500 in quick assets, so its quick ratio is 1.5, or $1,500 / $1,000. In conclusion, the quick ratio is a key liquidity metric that measures a company’s ability to meet its short-term financial obligations.

Submit to get your question answered.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. The quick ratio is often called the acid test ratio in reference to the historical use of acid to test metals for gold by the early miners.

Quick Ratio or Acid Test Ratio

A quick ratio greater than 1 generally indicates that a company is in good financial health, as it can cover its short-term obligations. In our example, a quick ratio of 2 can be seen as a robust financial position, suggesting that the company is well-equipped to handle any short-term financial uncertainties or obligations. Short-term investments or marketable securities include trading securities and available for sale securities that can easily be converted into cash within the next 90 days.

Accounts receivable (A/R) is the money that customers owe you. These assets are less liquid than cash and marketable securities. But companies how to do your company’s payroll yourself still expect to receive the money within 90 days. Marketable securities are short-term assets that can take a few days to turn into cash.

Our Services

- A strong Quick Ratio can boost investor confidence by demonstrating that the company is well-positioned to meet its short-term obligations without financial strain.

- Did you know that data in the annual report also allows you to calculate profitability ratios, such as the return on equity and assets?

- The quick ratio formula is quick assets divided by current liabilities.

- Yes, a very high quick ratio may indicate that a company is not efficiently using its assets, potentially hoarding cash instead of investing in growth.

- The quick ratio communicates how well a company will be able to pay its short-term debts using only the most liquid of assets.

This means the business has $1.10 in quick assets for every $1 in current liabilities. The Quick Ratio excludes inventory, focusing on more liquid assets. The Current Ratio includes inventory and is a broader measure of liquidity.

Early liquidation or premature withdrawal of assets like interest-bearing securities may lead to penalties or discounted book value. A strong Quick Ratio can boost investor confidence by demonstrating that the company is well-positioned to meet its short-term obligations without financial strain. A very high quick ratio, such as three or above, is not always a good thing. Such a high quick ratio means there’s too much cash in the bank. Small businesses are prone to unexpected financial hits that can disrupt cash flow.

This will give you a better understanding of your liquidity and financial health. Current liabilities represent financial obligations due within a year. This can include unpaid invoices you owe and lines of credit you have balances on.

Regardless of which method is used to calculate quick assets, the calculation for current liabilities is the same, as all current liabilities are included in the formula. This financial indicator requires to compare the value of the short-term assets (cash & near cash assets) to the one of short-term liabilities. Please take account of the fact that this ratio does not include into calculation the inventories because they are considered less liquid. You can use this acid test ratio calculator to compute a company’s acid-test ratio. The acid test ratio, which is also referred to as the quick ratio or liquid ratio, provides an indication of an organization’s immediate short-term liquidity. It’s important to compare the quick ratio of a company with its peers.