Now, let’s assume that the store becomes more confident in the popularity of these shirts from the sales at other stores and decides, right before its grand opening, to purchase an additional 50 shirts. The price on those shirts has increased to $6 per shirt, creating another $300 of inventory for the additional 50 shirts. The company sells an additional 50 items with this remaining inventory of 140 units. The cost of goods sold for 40 of the items is $10 and the entire first order of 100 units has been fully sold. The other 10 units that are sold have a cost of $15 each and the remaining 90 units in inventory are valued at $15 each or the most recent price paid. Businesses in industries with rising costs or prices typically use the LIFO method.

Warehouse Replenishment: Types, Tips & More

The oldest costs will theoretically be priced lower than the most recent inventory purchased at current inflated prices in this situation if FIFO assigns the oldest costs to the cost of goods sold. FIFO operates on the principle that older stock exits first, while LIFO assumes newer items are sold before older ones. During inflationary periods, FIFO typically shows lower costs and higher profits, whereas LIFO often results in higher costs and lower profits.

What Is LIFO?

- It matches current sales prices with historical costs, reflecting actual profit per sale.

- When considering which to use, businesses must weigh strategic considerations like financial reporting, tax implications, and compliance with standards.

- FIFO can be useful during periods of inflation when higher profits may positively affect investor perception.

- Companies must make an assumption about their flow of inventory goods to assign a cost to the inventory remaining at the end of the year.

- The other 10 units that are sold have a cost of $15 each and the remaining 90 units in inventory are valued at $15 each or the most recent price paid.

It also simplifies the process of mergers, acquisitions, or entering new markets. The FIFO method’s logical approach to inventory flow makes cost tracking and calculation easier. This simplicity reduces accounting errors, speeds up month-end closings, and streamlines audits. The simplifies onboarding for new employees and streamlines accounting processes, which reduces overall operational expenses. When implementing FIFO, create a robust system that aligns your physical inventory with your digital records. Invest in quality inventory management software, train your staff thoroughly, and conduct regular audits.

What Is The FIFO Method? FIFO Inventory Guide

And, in some cases, FIFO could actually decrease profit margins, especially during inflation or when inventory costs increase. FIFO can also help warehouse managers with inventory analysis for more accurate inventory records. This method ensures that the first products you purchase or create are the first to go out when customers place orders. By using older stock first, FIFO reduces the likelihood of inventory stagnation and minimizes holding costs. To better understand the FIFO inventory method, imagine a gumball machine. The gumballs at the bottom of the machine were likely the first ones added.

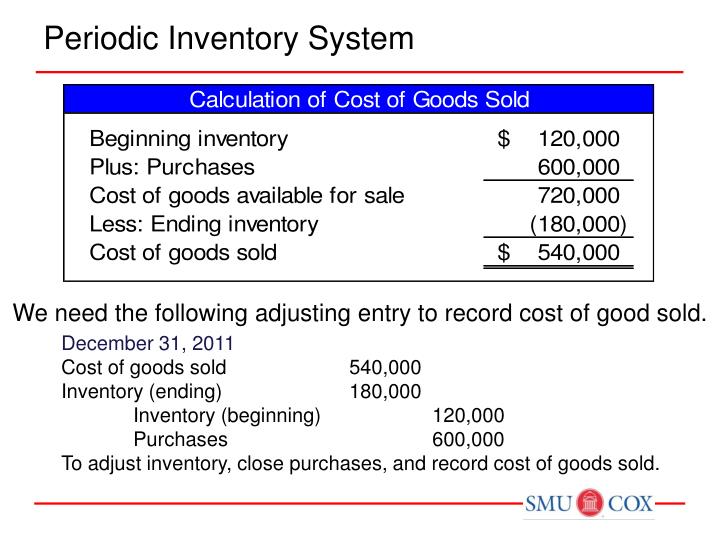

3: Methods Under a Periodic Inventory System

Of the many inventory valuation methods for inventory, it remains one of the most popular. Adopting a FIFO strategy can help businesses manage stock flow more efficiently and generate accurate financial reporting. Powerful mobile inventory solutions like RFgen can help your enterprise revolutionize inventory management with automation and barcoding, regardless of what inventory valuation method you use. However, LIFO inventory management may not be the best choice for managing perishable goods or items with limited shelf life. Although it may provide income tax benefits by reducing profits, it’s not suitable for all situations.

Tanner joined McKonly & Asbury in 2022 and is currently a Senior Accountant with the firm’s Assurance & Advisory Segment, servicing our Manufacturing and Nonprofit clients. Last-in, first-out (LIFO) is another technique used to value inventory, but it’s not one commonly practiced, especially in restaurants. what’s the recovery rebate credit On Sunday night, they count the remaining inventory and find 50 oranges left. With over a decade of editorial experience, Rob Watts breaks down complex topics for small businesses that want to grow and succeed. His work has been featured in outlets such as Keypoint Intelligence, FitSmallBusiness and PCMag.

Maximizing resources can also lead to a reduction in waste and tangible cost savings with minimal losses. Additionally, FIFO can positively influence inventory management techniques and enhance storage space utilization for logistics providers that support these businesses. The first-in first-out (FIFO) method is an inventory management process based on the principle that your oldest inventory items are the first to use or sell.

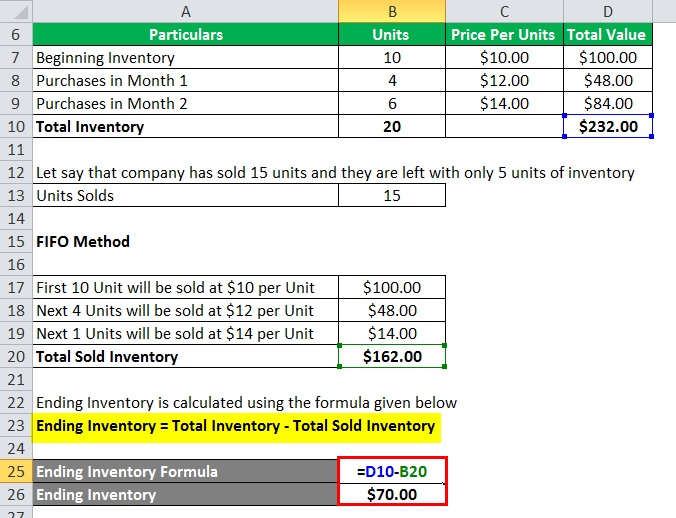

The cost of goods sold would now be $6,625, which is more expensive than it was during the period of rising prices. Let’s say you’ve sold 15 items, and you have 10 new items in stock and 10 older items. You would multiply the first 10 by the cost of your newest goods, and the remaining 5 by the cost of your older items to calculate your Cost of Goods Sold using LIFO. Under the LIFO Method, cost of goods sold is calculated using the most recent inventory first and then working our way backwards until the sales order has been filled. This way, stores move these food items before their sell-by date, reducing waste and ensuring customers always receive fresh products. Product quality is upheld while also complying with health and safety standards.

It can lead to higher reported profits during inflation periods, as older, less expensive inventory is expensed first while newer, potentially pricier items remain in stock. Based on the examples shown above, Pinky’s Popsicles ending inventory and cost of goods sold is the same – regardless of the method used! Utilizing the FIFO assumption, you can see that if prices are rising, the FIFO method will result in the highest ending inventory compared to other inventory cost flow assumptions. In our Pinky’s Popsicles example, the prices were rising because Batch 1 was purchased for $0.75 per unit, whereas Batch 2 cost $0.90 per unit.