The income summary account is also known as the temporary income statement account. Temporary accounts are those that are closed at the end of an accounting cycle. If you are using accounting software, the transfer of account balances to the income summary account is handled automatically whenever you elect to close the accounting period. It is entirely possible that there will not even be a visible income what kind of account is income summary summary account in the computer records. It is also possible that no income summary account will appear in the chart of accounts.

- Direct costs can include parts, labor, materials, and other expenses directly related to production.

- The income summary account process ensures the generation of accurate financial statements and ensures that the revenues and expenses for the accounting period are accurately closed for that period.

- It is an essential tool in the accounting system because it allows business owners and managers to track revenues and expenses, prepare financial statements, and make informed decisions.

- It transfers it to a balance sheet, which gives more meaningful output for investors, and management, vendors, and other stakeholder.

Related AccountingTools Courses

We also have an accompanying spreadsheet which shows you an example of each step. The balance in Retained Earnings was $8,200 before completing the Statement of Retained Earnings. According to the statement, the balance in Retained Earnings should be $13,000. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Helping Learn Accounting – Financial & Managerial

By understanding how to prepare an income summary account, businesses can make informed decisions about their financial performance and make strategic plans for the future. You can either close these accounts directly to the retained earnings account or close them to the income summary account. Instead of sending a single account balance, it summarizes all the ledger balances in one value. It transfers it to a balance sheet, which gives more meaningful output for investors, and management, vendors, and other stakeholder. An income summary account summarizes all the operating and non-operating business activities on one page and concludes the company’s financial performance. This process updates retained earnings and resets the income summary account to zero.

Streamlined closing process

Our debit, reducing the balance in the account, is Retained Earnings. If you have only done journal entries and adjusting journal entries, the answer is no. Let’s look at the trial balance we used in the Creating Financial Statements post. While an Income statement is vital for the business, it should be noted that an Income statement is just one of the three financial statements.

Non-operating items are further classified into non-operating revenue and non-operating expenses. This makes it easier for users of the income statement to better comprehend the operations of the business. It shows whether a company has made a profit or loss during that period. Capital One Financial Corporation declared their net income closing entries for the fourth quarter ledger account of 2022. It was declared at $1.2 billion or %3.03 for each diluted common share. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser.

- Remember that the periodicity principle states that financial statements should cover a defined period of time, generally one year.

- An income summary account is a temporary account used at the end of an accounting period to collect all revenue and expense account balances.

- Then, you transfer the total to the balance sheet and close the account.

- It is also possible that no income summary account will appear in the chart of accounts.

- Income statements can be complex, but understanding the different components is crucial to interpretation.

- The income summary account is prepared by debiting revenue accounts and crediting expense accounts.

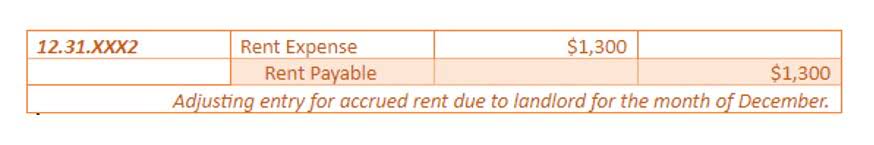

It is a special type of account that is used to aggregate all the revenues and expenses of a business over a specific period of time, such as a month, quarter, or year. Income summary account is a summary of the income statement, and it is used to report the net income or net loss of the business. The income summary account is prepared by debiting revenue accounts and crediting expense accounts. The balances of the transferred amounts should match with the net income or loss for the year. The income summary account balance is then transferred to retained earnings or the capital account in the case of a sole proprietorship.

How is income summary account prepared?

- An Income Statement is a financial statement that shows the revenues and expenses of a company over a specific accounting period.

- It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it.

- The trial balance, after the closing entries are completed, is now ready for the new year to begin.

- The other two important financial statements are the balance sheet and cash flow statement.

- At the end of the period, the net income or loss is calculated and transferred from the income summary to the owner’s equity account.

- It shows whether a company has made a profit or loss during that period.

The income summary account is a temporary account used to store income statement account balances, revenue and expense accounts, during the closing entry step of the accounting cycle. In other words, the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made. The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period.

What is the purpose of an income summary account?

It is used to calculate the net income or net loss of the entity, and provides valuable insights into the financial performance of the business or individual. By following the steps outlined in this article, you can prepare an accurate income summary account and make better financial decisions. After Paul’s Guitar Shop prepares its closing entries, the income summary account has a balance equal to its net income for the year. Bookkeeping for Chiropractors This balance is then transferred to the retained earnings account in a journal entry like this. Once the temporary accounts are closed to the income summary account, the balances are held there until final closing entries are made.