Contents

All of the information and materials available on PublicFinanceInternational.org is not financial advice and is for general informational purposes only. Nor PublicFinanceInternational or any of our affiliates makes any recommendation or implies any action based on the information we proved to you. We don’t make any solicitation or recommendation to take any action or trade or invest in any financial instrument, asset, or commodity.

You can read what each demo trading account offers by scrolling down. Day trading practice depends largely on the strategy that’s being used to trade. Traders should choose the best broker platform for their needs based on their trading preferences and paper trade on those accounts. Paper stock trading platforms allow traders to trade stocks, compete, and train on demo accounts.

Ideally, you should choose a platform with a broker that you would want to use for live trading. This way you can familiarize yourself with the platform you want to use. Virtual trading or a stock market simulator gives you a sense of security when practicing trades or getting to know a new platform. They use real-time information to test the success or failure of your practice trades.

Paper Trade’ comes from an old stock market practice of writing down buying and selling stocks on paper. The development of online trading platforms and software has increased the ease and popularity of paper trading. Today’s simulators allow investors to trade live markets without the commitment of actual capital and the process can help to gauge whether investment ideas have merit. Online brokers such as TradeStation, Fidelity, and TD Ameritrade’s thinkorswim offer clients paper trading simulators. As I mentioned above, using real-life to learn day trading, buying and selling stocks, options, futures, and other financial instruments will be extremely challenging.

One of the key features of paper trading is that you aren’t using real money. Day trading platforms are designed for fast trade executions, flexible order routing scenarios and hotkey trading. They are all downloadable trade99 review platforms for installation on a personal computer. Popular day trading platforms are Cobra TraderPro, DAS Trader Pro, and Sterling Trader Pro. A cool paper trading account feature TradingView offers is chart trading.

- Many investment strategies require expertise and technical knowledge of the stock market.

- Trade on platforms designed to meet the demands of currency traders.

- Robinhood investment platform does not allow traders to paper trade.

- Due to high brokerage and commission In paper trading, as this method does not involve any commission, an investor might mistake miscalculating the brokerage.

- You have to treat your paper trading just as carefully as you would handle real money trading.

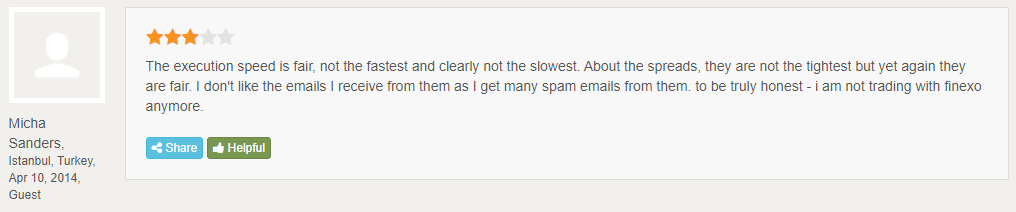

Having research and tools available helps you develop trading strategies and decide which instruments to invest in. It is also important to check out the features, fees, and securities fxdd review of the live account and make sure it suits your needs. When an order is put in for trade it goes to the exchange where it is matched with another trader and the trade is carried out.

This security might cause you to trade more freely than you would once you start live trading. You should keep in mind that it does not account for your emotional investment in your stocks or how losses could affect you mentally. We base our analysis on a variety of factors such as fees, commissions, tools, security, regulation, and more. You also don’t have to connect your bank account to your paper trading platforms, so there’s no security risk. Most paper trading platforms don’t require a fee, meaning you can practice investing for free. Paper trading is an excellent way to test advanced investing strategies that call for more experience.

Next, it’s also wise to enter a stop-loss and take-profit order value. As we explained earlier, this will allow you to get to grips with risk-management when paper trading. Once you have registered – you can then start using the eToro paper trading simulator straight away. First, you’ll need to click on the ‘Real’ button on the left-hand side of the dashboard and then click on ‘Virtual Portfolio’.

Best Paper Trading Platform 2023 List

This will not only overcome the main obstacle of demo accounts, but will ease the transition from demo account to real accounts. Paper trading might seem easy, but there is an important component missing. However, there are some risks to paper trading which should not be ignored. Some people would suggest not to begin with a demo account for a number of reasons.

We recommend you to visit our trading for beginners section for more articles on how to trade Forex and CFDs. The EUR/USD, GBP/USD and commodity dollars could all fall back if sentiment towards risk remains subdued. Experience award-winning platforms with fast and secure execution, and enjoy tight spreads from 0.5 pts on FX and 1 pt on indices.

Generic Trade

It doesn’t really matter whether you start with a demo account from an online broker or use a standalone trading tool. The most important thing is that you practice paper trading within a demo account or with a stock market simulator. When beginning, use the demo account settings to adjust the virtual money value as close as possible to your upcoming live trading value. And please be aware that you cannot reset your real money trading account with one mouse click.

There’s not a set amount of time you should paper trade before you start investing your actually money. These platforms are often close to or identical to a broker’s regular trading account. These help you learn not only what happened with your virtual trades, but why certain outcomes occurred. Using paperMoney, you can test out new investing strategies that you aren’t ready to try in the real market. It’s well-suited to learning investing strategies like options, futures and forex. Take a look at the trade ideas review to learn why Trade Ideas Pro A.I.

What Is a Paper Trade? Definition, Meaning, and How to Trade

Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models. If you are looking to specialize in options trading we recommend the IQ option platform if you are outside of the US, and the Interactive Brokers for those living in the US. This lets you pinpoint locations on a stock chart that you want to execute trades on from the same screen.

Any strategy, an exit price is eventually written down and the beginner must repeat the cycle before adequate data are obtained to evaluate progress. The key advantage of a paper trading account is that it offers traders the capability of testing diverse setups. You may discover how to run trades, but with no risk of real cash. You should also check whether the platform offers securities you want to trade. While this is not as important if you’re going to be using a paper trading account, this is important if you decide to go live.

With that said, you likely won’t need this much – as you’ll want to paper trade with stakes that mirror your actual investment budget. When it comes to the Plus500 paper trading facility, you can register for this specifically by selecting the ‘Demo Account’ option. In doing so, you can start trading risk-free without needing to make a deposit. On both the real and demo accounts, Plus500 allows you to seamlessly switch between its desktop platform and mobile app. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

What Will Happen Once You Switch from Your Paper Trading Account to a Real Trading Account?

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Test investment strategy – Using paper trading, any new investor can try their investment strategies and test to see whether they will be successful in the real stock market. It is equally convenient for experienced investors trying their luck with a new approach that hasn’t been used in the real market yet. The wide array of trading markets attracts an abundance of traders who are new to the world of grading. Some new traders tend to be those who are seeking long-term trades.

Nvstr lets you manage your profile and has a feature that suggests ETFs or stocks that you could buy or sell to keep your profile balanced. TD Ameritrade is known as being a platform that offers a rich selection of trading features. Because emotion often plays a big role in investing, you might find that you trade differently while paper trading than you would with your actual investment portfolio. Tradestation is another service that allows you to practice trading without using real money. This happens because CFDs are not an original financial instrument and brokers want to protect themselves as much as possible.

Paper trading describes a simulated market environment where buying and selling trading decisions are written down by the investor instead of placing real orders at a brokerage. A paper trade refers to the use of simulated trading to practice the purchasing and selling of securities without requiring real capital. As you look for the best place where to practice your trades, consider paper trading platforms that offer live market feeds before you start with real capital. This is important because you’ll want to be able to trade without delayed feeds or processing orders. In most cases, the dummy stock market on paper trading platforms follows the real market.

When it comes to fees – and like most US-based brokerage sites these days, you can buy and sell American stocks without paying any commission. Other markets will attract a dealing fee that will vary depending on your account type of the respective asset or exchange. Launched in 1975 – TD Ameritrade needs no introduction in the online brokerage scene. With more than 11 million clients now using the platform – this top-rated platform gives you access to every asset class under the sun.

Step 5: Deposit and Upgrade to Real Money Account

This can affect your trading strategy and the kind of risks you are prepared to take. For beginner investors, paper trading is a great way to get to know how the stock market works fxchoice review before you dive into real investing. When you start paper trading, you’ll get $1 million of play money to buy and sell assets like you would in your normal Webull trading account.

Common to all new traders is hesitation when it comes to placing trades and of course, concern at losing money from their trading. Investopedia does not provide tax, investment, or financial services and advice. Investing involves risk, including the possible loss of principal.